US Bank Profits Slip 1.2% in Q3

Image source: FDIC Quarterly Banking Profile, Nov. 30, 2021

By Pete Schroeder

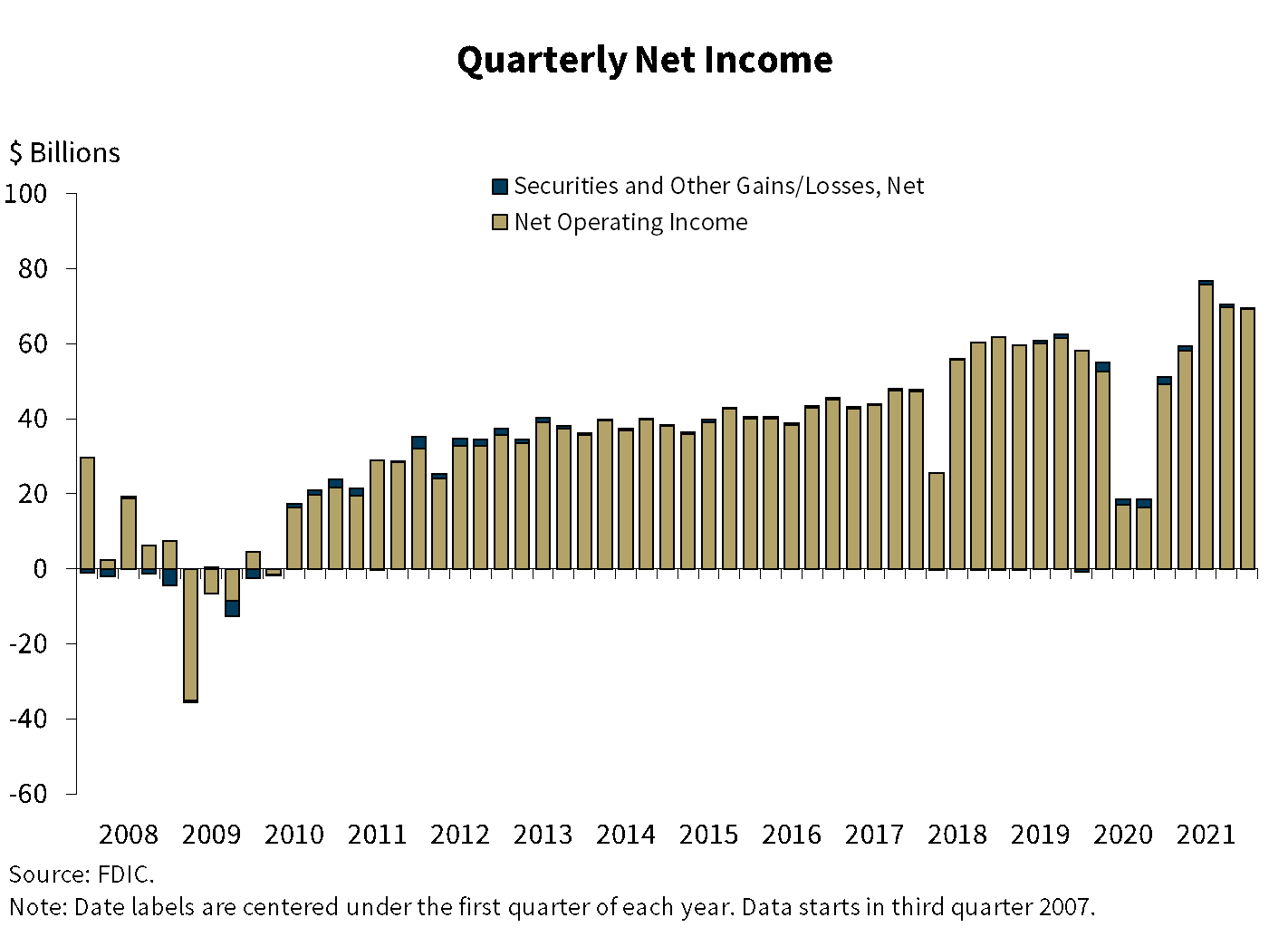

U.S. bank profits fell 1.2% in the third quarter of 2021 to $69.5 billion as firms were slower to shrink their credit loss provisions and grappled with low interest rates, the Federal Deposit Insurance Corporation reported Tuesday.

Bank profits are still up nearly 36% from the same time a year ago when banks were still rushing to set aside funds to guard against pandemic-driven loan losses.

Banks have been shrinking those loan loss provisions for three straight quarters, but slowed the rate of decline in the third quarter, dropping it by $5.2 billion compared to 10.8 billion in the second quarter.

As banks continued to shrink those reserves, the rate of non-current loans for banks fell to 6.3%. The net charge-off rate for loans no longer expected to be repaid fell to 0.19%, the lowest level on record.

Total loan balances were up slightly, as two-thirds of all banks reported annual profit growth. Nearly 96% of banks were profitable.

"With strong capital and liquidity levels to support lending and protect against potential losses, the banking industry continued to support the country's needs for financial services while navigating the challenges presented by the pandemic," said FDIC Chairman Jelena McWilliams in a statement.

The net interest margin for banks rose from a record low in the second quarter to 2.56%, as banks reported a $5.2 billion in increase in interest income, a slight uptick from the quarter prior.

Reporting by Pete Schroeder; Editing by Chizu Nomiyama and Edmund Blair.

_____